-

Brand & Communications

-

Customer Research

-

Market Opportunity

-

Product Research

Industry & audience expertise

Analyze

-

Case Study

Case StudyHow The Wall Street Journal cut through the generative AI haze with NewtonX insights

-

Report

ReportAutomation for Performance: Global overview and marketer’s guide to AI-powered advertising

-

Report

ReportBeyond the Deal: Why Brand Migration Makes or Breaks M&A

-

Article

ArticleThe 2026 AI paradox: Why evidence density is the new B2B moat

-

Article

ArticleThe AI Frontier: How Digital Twins Are Reshaping Product Marketing

-

Report

ReportANA + NewtonX: The Confident B2B Marketer (and how you can be one too)

-

Case Study

Case StudyHow Coinbase Integrates AI Insights into Its Go-to-Market Strategy

-

Case Study

Case StudyTikTok + NewtonX Quantify AI Automation Leadership in Advertising

-

Case Study

Case StudySchneider Electric exposes America’s hidden water crisis and calls for smart infrastructure action at Climate Week

-

Press

PressNewtonX joins The Debating Group and MRS for a House of Commons debate on the future of AI & research

-

Press

PressSalesforce Releases CIO Study 2026 as CIOs Enter the Era of Scale

-

Press

PressGreenbook Selects NewtonX as the B2B Data Provider for the 2025 GRIT Business & Innovation Report

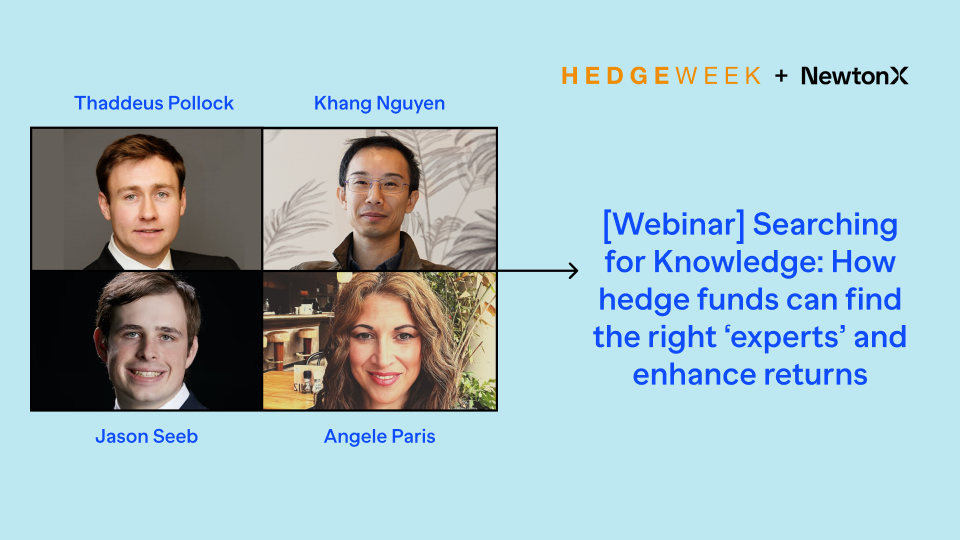

[Webinar] Searching for Knowledge: How hedge funds can find the right ‘experts’ and enhance returns

Join Hedgeweek and NewtonX for an insightful webinar as we reveal how finding the right 'experts' can help decision making and enhance your fund's returns.

Are you an Analyst, Portfolio Manager, Partner, or Chief Investment Officer at a hedge fund? Looking for ways to maximize the value of your research spend? Watch our webinar, in partnership with Hedgeweek, to learn:

- How are managers currently using expert networks – and how is this evolving?

- What is the demonstrable output of using the right expert guidance – how can it improve decision making and fund performance?

- Can AI and tech help you find a deeper pool of expertise? How does this work?

- How do you ‘scale’ expertise by blending quantitative and qualitative methods

Speakers:

- Khang Nguyen, NewtonX Head of Content & Compliance

- Angele Paris, Global Fund Media, Head of Partners Projects

- Thaddeus Pollock, Cramer Rosenthal McGlynn, Partner & Portfolio Manager

- Jason Seeb, Narwhal Capital Management, Investment Analyst

Hedge funds require prescient and contrarian perspectives to outperform the market and deliver positive results to investors. That said, it’s challenging to acquire the right knowledge to quickly and confidently validate investment theses. Traditional B2B research methods relying on 1:1 interviews struggle to provide holistic competitive intelligence. Thanks to cutting-edge research technology, there’s a new way for hedge funds to maximize the value of their research spend.

Share

Sign up for our newsletter, NewtonX Insights:

Related Content

Hedgeweek: Leveraging new research methods to drive deeper insights

Originally published by Hedgeweek on July 28th, 2022.

read moreThe next generation of insights for hedge funds

Hedge funds require prescient and contrarian perspectives to outperform the market and deliver positive results to investors. To ensure high returns from volatile markets, equity investors require accurate data from end-to-end research services. It is

read moreHow a hedge fund identified contrarian responses and risks missed by expert calls

Our targeted surveys helped a leading hedge fund reach more professionals and discover contrarian insights that earlier 1:1 consultations couldn’t deliver.

read moreThe Quickest Way for Funds to Get Quality Data: Meet NewtonX Prime

Leading firms are using new technology to maintain their edge, and those without it risk falling behind.

read more

Hedgeweek: Elevating investment research techniques

By conducting expert surveys through specialist firms, investment managers can reach a greater number of professionals in a fraction of the time, and collect reliable data they can use to form the basis of their investment decisions.

read more

![[Webinar Recap] Is B2B ready for synthetic sample? Yes – if you know how to augment it](https://www.newtonx.com/wp-content/uploads/2024/10/Webinar-synthetic-sample-greenbook-1024-1920px-feature-image-1-300x169.jpg)

![[Webinar Recap] The future of B2B research starts with the death of panels](https://www.newtonx.com/wp-content/uploads/2024/07/TKH-8.22-Karine-Pepin-webinar-1920px-feature-image-300x169.jpg)

![[Webinar Recap] Ditch the Bad Data with Greenbook’s Lenny Murphy as Your Guide](https://www.newtonx.com/wp-content/uploads/2024/05/tkh-greenbook-newtonx-lenny-murphy-cutting-research-cost-speakers-v-21920px-feature-image-300x169.jpg)