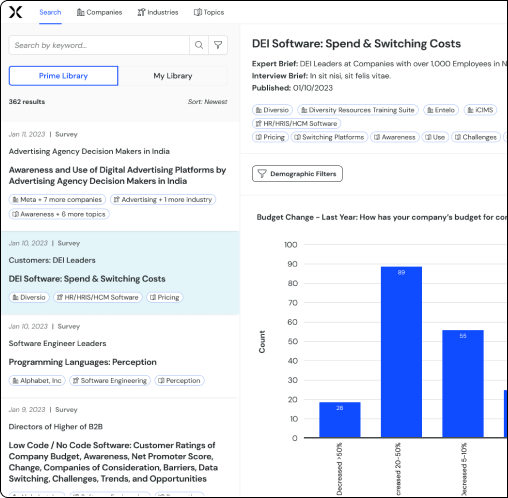

Introducing NewtonX Prime: Instant insights for smarter investing

NewtonX Prime is the only expert intelligence platform that gives investors and analysts a competitive edge via unlimited access to our full database of expert surveys and transcripts.